DISCO, a major Japanese crystal-circular cutting machine manufacturer, used last quarter (April-June 2025) to reflect the breakdown of the supply amount of customers' investment intentions. However, due to the increase in expected daily volume, DISCO's financial forecast for this quarter (July-September) will drop by 20% in market expectations and pure profit estimates. Today, stock prices plummeted.

According to Yahoo Finance's quotes, as of 9:05 am on the 18th, DISCO plummeted 8.11% to 43,160 days round.

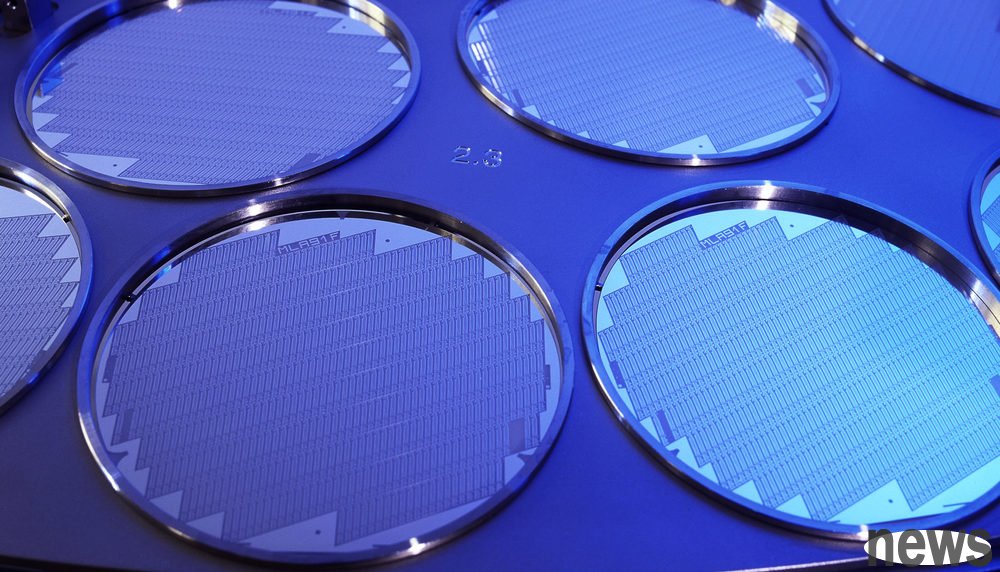

DISCO announced its financial report last quarter (April-June 2025) after the 17th: Due to the continued strong demand for generative AI, the delivery of precision machining devices such as cutting machines (Dicer) and grinders (Grinders) used in semiconductor production has been booming. The combined revenue grew by 8.6% to 89.914 billion yen compared with the same period last year, the combined revenue grew by 3.3% to 34.48 billion yen, and the combined profit increased by 0.2% to 23.767 billion yen, and the combined profit increased by 0.2% to 23.767 billion yen, and the combined profit has set a record of historical record in the same period.

(Source: DISCO)

DISCO pointed out that the amount of shipments available to reflect customers' investment intentions last quarter increased by 9.9% to 11.1142 billion yen compared with the same period last year, and the quarterly shipments exceeded 11.0282 billion yen in October-December 2024, setting a record high.

DISCO pointed out that the direct connection between the company's revenue status and customer equipment investment intention is low, because the products sold will be included in the revenue calculation only after the product is completed. Therefore, the revenue is easily affected by the experience and revenue. It is necessary to observe the customer's investment intention and use the company's "transfer amount" trend to be more accurate.

DISCO pointed out that due to the expected increase in the daily round and the difficult forecast for customer experience, the combined investment revenue estimate for this quarter (July-September 2025) will decrease by 5% to 91.2 billion yen compared with the same period last year, the combined investment profit estimate will decrease by 22% to 33.2 billion yen, and the combined pure profit estimate will decrease by 21% to 23.5 billion yen.

DISCO estimates that the shipment amount this quarter will drop by 14% year-on-year to 83.6 billion yen, and the quarterly shipment amount will reach a new low in the seven quarters (77.3 billion yen since the October-December 2023 quarter).

DISCO's financial estimate for the above-mentioned quarter is based on the premise of 1 USD 135-day round and 1 Euro yuan to 160-day round.

According to Japanese media reports, the average market estimates that DISCO's revenue, profit and purity will be 103.4 billion yen, 44.7 billion yen and 33.4 billion yen. The value announced by DISCO is above market expectations.

DISCO will only release financial estimates for the most recent quarter, rather than the full-year financial estimates because customer investment intentions will change dramatically in the short term and make it difficult to estimate demand.